The Rise of Green Hydrogen: Market Growth and Projections

The clean energy landscape is on the cusp of a revolution, and green hydrogen is leading the charge. This promising technology has garnered significant attention and investment from governments, companies, and industries worldwide in recent years. As the energy sector shifts towards cleaner, more sustainable options, the demand for green hydrogen will skyrocket. This chapter will explore the market growth and projections for green hydrogen, providing an overview of the exciting opportunities and developments.

A Look at the Numbers

The global green hydrogen market is projected to reach $89.18 billion by 2030. In perspective, the market was valued at a modest $1.83 billion in 2021. This rapid expansion demonstrates that the market is rushing, with new companies and investors entering the scene and established players increasing their efforts to stay ahead.

Understanding the Drivers

Several vital drivers are propelling the green hydrogen market forward:

Declining production costs: The cost of producing green hydrogen through electrolysis, for example, has fallen dramatically in recent years. According to Bloomberg New Energy Finance, Green Hydrogen could be produced for $0.70 to $1.60 per kg in most of the world by 2050, making it competitive with natural gas if the prices keep decreasing. The estimated levelized cost of producing renewable hydrogen in 2023 is about 4.5 to 6.5 USD per kilogram. The cost target by 2030 is $2.5–4.0 kg.

Growing energy demand: The increasing need for cleaner, more efficient energy solutions has pressured companies to find viable alternatives. As companies move away from traditional energy sources, they discover that green hydrogen is well-positioned to play a crucial role in reducing emissions. According to a Hydrogen Council report, “Hydrogen momentum is strong: 1,418 projects have been announced globally –

USD 570 billion investments announced.”

Strengthening climate goals: Many governments are reinforcing their commitments to the Paris Agreement by increasing their ambition to mitigate climate change. Green hydrogen adoption becomes even more critical as governments commit to policies supporting clean energy production and invest heavily in clean infrastructure. For example, the European Union has set a goal of becoming carbon neutral by 2050, and green hydrogen is expected to play a vital role in achieving this goal.

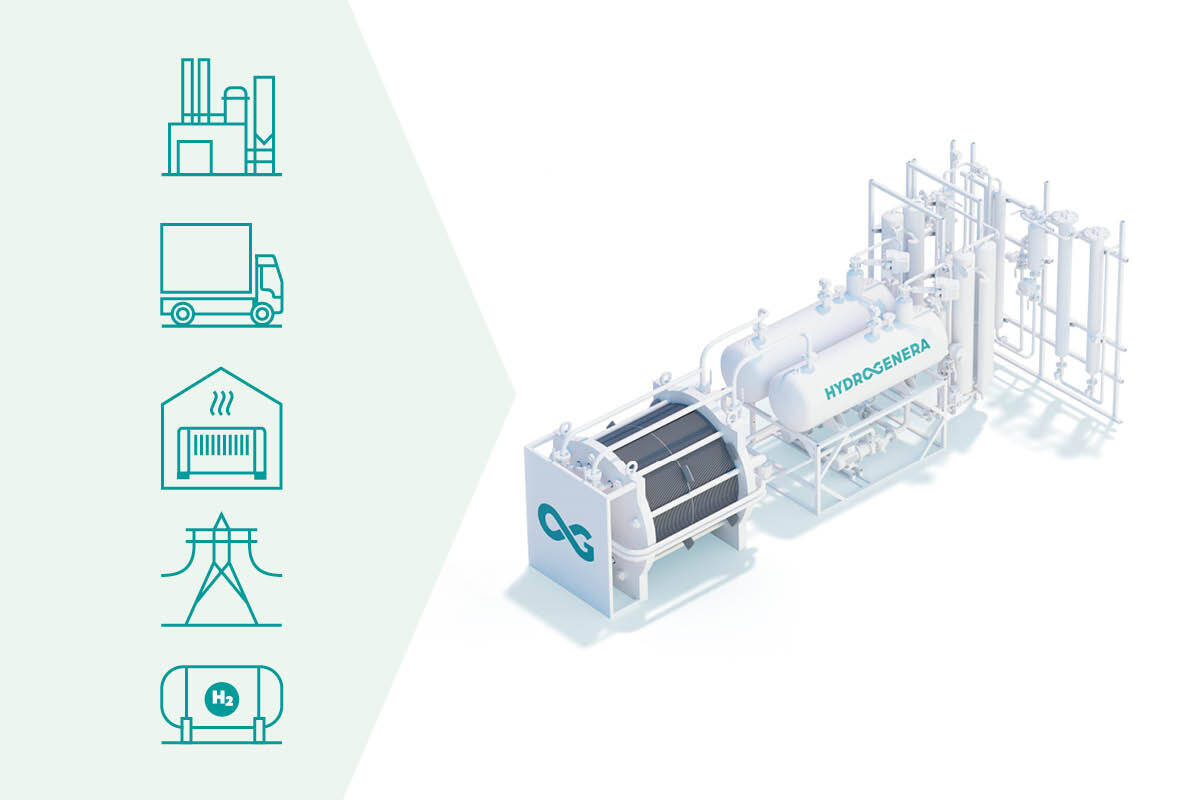

Driving Demand: Key Sectors Embracing Green Hydrogen

As the world transitions towards a low-carbon economy, various sectors embrace green hydrogen as a critical component of their decarbonisation strategies. This chapter explores the key sectors driving demand for green hydrogen, including industry, transportation, power generation, and buildings.

Heavy Industry: A Major Consumer of Green Hydrogen

The industrial sector is one of the largest energy consumers, and green hydrogen is becoming an increasingly important part of its energy mix. According to a report by the International Energy Agency (IEA), the industrial sector accounts for around 37% of global energy demand in 2022. Green hydrogen is being used in various industrial applications, including:

Chemical production: Green hydrogen is used as a feedstock for producing chemicals such as methanol and ammonia.

Steel production: Green hydrogen reduces steel production's carbon footprint, with several companies investing in hydrogen-based steel production technologies.

Refineries: Refineries are also adopting green hydrogen to reduce their carbon footprint and improve the efficiency of their operations.

By incorporating green hydrogen into their operations, these industries can significantly reduce greenhouse gas emissions and contribute to a more sustainable energy future.

Transportation: A Growing Market for Green Hydrogen

The transportation sector is another crucial area where green hydrogen is gaining traction. The global hydrogen fuel cell vehicle market is set to reach USD 33.4 Billion by 2030. Green hydrogen is being used in various transportation applications, including:

Fuel cell electric and ICE vehicles: Green hydrogen powers fuel cell and ICE vehicles, which offer a zero-emission alternative to traditional fossil fuel-based vehicles.

Hydrogen fueling stations: Several companies are investing in developing hydrogen fueling stations, which will be critical to supporting the growth of the hydrogen fuel cell vehicle market.

Maritime transport: Green hydrogen is also being explored as a clean energy source for ships, with several projects underway to develop hydrogen-powered vessels. This could significantly reduce greenhouse gas emissions from the shipping industry.

Rail transport: Additionally, green hydrogen is considered a potential fuel source for trains, offering a cleaner alternative. This could lead to a significant reduction in emissions from the rail sector.

Power Generation: A Key Application for Green Hydrogen

Green hydrogen is also being used in power generation applications, including:

Gas turbines: Green hydrogen can power gas turbines, which provide a low-carbon alternative to traditional fossil fuel-based power generation.

Fuel cells: Green hydrogen can power fuel cells, which provide a highly efficient and low-carbon source of electricity.

The Perfect Storm: Technological Advancements, Economies of Scale, and Supportive Policies

The green hydrogen market is experiencing a perfect storm of technological advancements, economies of scale, and supportive policies that drive down costs and increase adoption. This chapter will explore the key factors contributing to its growth.

Technological Advancements

Advances in technology are playing a crucial role in reducing the cost of green hydrogen production. Some of the key technological advancements include:

Improvements in electrolysis: Technological advancements will significantly decrease the cost of electrolysis. As we have mentioned, production costs are decreasing, and the target cost of $2.5–4.0 kg by 2030 will drive further demand for clean energy and the need to reduce carbon emissions globally.

Development of new electrolyser materials: Researchers are developing new materials for electrolysers that are more efficient and less expensive than traditional materials. For example, a team of researchers at the University of California, Los Angeles (UCLA) has developed a new, more efficient material.

Advances in hydrogen technology: Recent advancements in hydrogen technology have made significant strides in the transportation sector, particularly in the automotive and aviation industries.

One critical advantage of hydrogen-powered vehicles is their relatively low refuelling time compared to electric cars. Companies like Hyundai and NamX HUV are introducing innovative solutions to optimise performance and reduce refuelling time.

In the aviation industry, hydrogen is expected to be crucial in transforming air travel into a zero-carbon emission transportation mode. Potential technologies use hydrogen as a primary energy source for propulsion or the synthesis of liquid fuels.

Economies of Scale

As the demand for green hydrogen increases, manufacturers achieve economies of scale that drive down costs. Large-scale production of electrolysers and fuel cells enables manufacturers to reduce costs and increase efficiency.

As of October 2023, there are 1,418 announced clean hydrogen projects globally, with a total investment of USD 570 billion. Key points include:

- 372 new projects have been announced since the previous publication.

- Over 1,000 projects aim to be commissioned by 2030.

- Giga-scale projects account for over USD 330 billion in investments.

- Regional breakdown:

- Europe: 540 projects, USD 193 billion in investments.

- North America: 248 projects, USD 12 billion growth in investments.

- Latin America: 120 projects, USD 85 billion in investments.

- India: 40 projects, 140% growth in investments.

- Middle East and China: 80% and 50% growth in investments, respectively.

Supportive Policies

Governments worldwide are implementing policies that support the development of the green hydrogen market. Some of the key policies include:

Tax credits: Governments are offering tax credits to companies that invest in green hydrogen production. For example, the US government provides a tax credit of up to $3 per kilogram of hydrogen produced.

Grants and funding: Governments are providing grants and funding to companies developing new technologies for green hydrogen production. For example, the European Union has announced plans to offer €113.5 million in funding for the development of hydrogen technologies.

Low-carbon fuel standards: Governments are implementing low-carbon fuel standards that require fuel producers to reduce the carbon intensity of their fuels. California, for example, has implemented a low-carbon fuel standard.

Reshaping the Energy Landscape: The Potential Impact of Green Hydrogen

Green hydrogen has the potential to reshape the energy landscape by providing a low-carbon alternative to traditional fossil fuels. This chapter will explore its potential impact on the energy sector and the environment.

Reducing Greenhouse Gas Emissions

One of the most significant benefits of green hydrogen is its potential to reduce greenhouse gas emissions.

According to the International Energy Agency (IEA), widespread adoption of green hydrogen could help to reduce greenhouse gas emissions by:

- 60% in the transportation sector by 2050

- 50% in the power generation sector by 2050

- 40% in the industrial sector by 2050

Green hydrogen is produced using renewable energy sources, such as solar or wind power, which do not emit greenhouse gases.

Improving Air Quality

Green hydrogen can also improve air quality by reducing pollutants such as nitrogen oxides and particulate matter. The International Energy Agency (IEA) estimates that:

- Green hydrogen could reduce CO2 emissions from the energy sector by up to 80% by 2050

- Green hydrogen could reduce air pollution-related health costs by up to $1.2 trillion per year by 2050

Enhancing Energy Security

Green hydrogen can also enhance energy security by providing a domestic energy source. According to a report by the European Commission, renewable energies could supply a substantial part of the European energy mix in 2050, of which hydrogen could account for up to 20%, notably 20-50% of energy demand in transport and 5-20% in industry.

Creating New Economic Opportunities

The production of green hydrogen could also create new economic opportunities. According to a report by the Hydrogen Council, the global green hydrogen market could create up to 30 million new jobs by 2050.

Challenges and Limitations

While green hydrogen has the potential to reshape the energy landscape, its adoption is also challenged and limited. One of the main challenges is the high cost of production, which can make it difficult for green hydrogen to compete with traditional fossil fuels. Additionally, infrastructure and storage challenges need to be addressed.

Conclusion

Green hydrogen can contribute significantly to the transition to a low-carbon economy. While its adoption is challenging and limited, the opportunities for growth and development are significant. By investing in research and development, infrastructure development, and policy and regulation, we can overcome the challenges and realise the opportunities of green hydrogen.

If your business wants to transition to a low-carbon economy, we invite you to contact Hydrogenera to learn more about our green hydrogen solutions. Our team of experts can help you navigate the opportunities and challenges of green hydrogen and develop a customised plan to meet your business needs.

Contact us today to learn how Hydrogenera can help you achieve your sustainability goals.

If your business wants to transition to a low-carbon economy, we invite you to contact Hydrogenera to learn more about our green hydrogen solutions. Our team of experts can help you navigate the opportunities and challenges of green hydrogen and develop a customised plan to meet your business needs.

Contact us today to learn how Hydrogenera can help you achieve your sustainability goals.