Introduction

Reducing carbon emissions has become one of the most pressing challenges of our time. With climate change looming large, the European Union has set ambitious targets to tackle this issue head-on.

The EU's commitment includes reducing emissions by 50-55% by 2030 compared to 1990 levels and achieving net-zero greenhouse gas emissions by 2050. These targets signal a clear need for more substantial efforts in the fight against climate change.

The carbon trading system is a significant tool in the EU's arsenal to combat carbon emissions. This system allows businesses to buy carbon allowances when they emit carbon dioxide during production.

The emissions trading scheme covers highly polluting industries like thermal power plants. However, starting in 2026, emissions from buildings and transport will also be included.

This carbon trading system operates through the European Emissions Trading System (EU ETS), playing a pivotal role in reducing greenhouse gas emissions in Europe.

The EU's commitment includes reducing emissions by 50-55% by 2030 compared to 1990 levels and achieving net-zero greenhouse gas emissions by 2050. These targets signal a clear need for more substantial efforts in the fight against climate change.

The carbon trading system is a significant tool in the EU's arsenal to combat carbon emissions. This system allows businesses to buy carbon allowances when they emit carbon dioxide during production.

The emissions trading scheme covers highly polluting industries like thermal power plants. However, starting in 2026, emissions from buildings and transport will also be included.

This carbon trading system operates through the European Emissions Trading System (EU ETS), playing a pivotal role in reducing greenhouse gas emissions in Europe.

EU ETS at a Glance

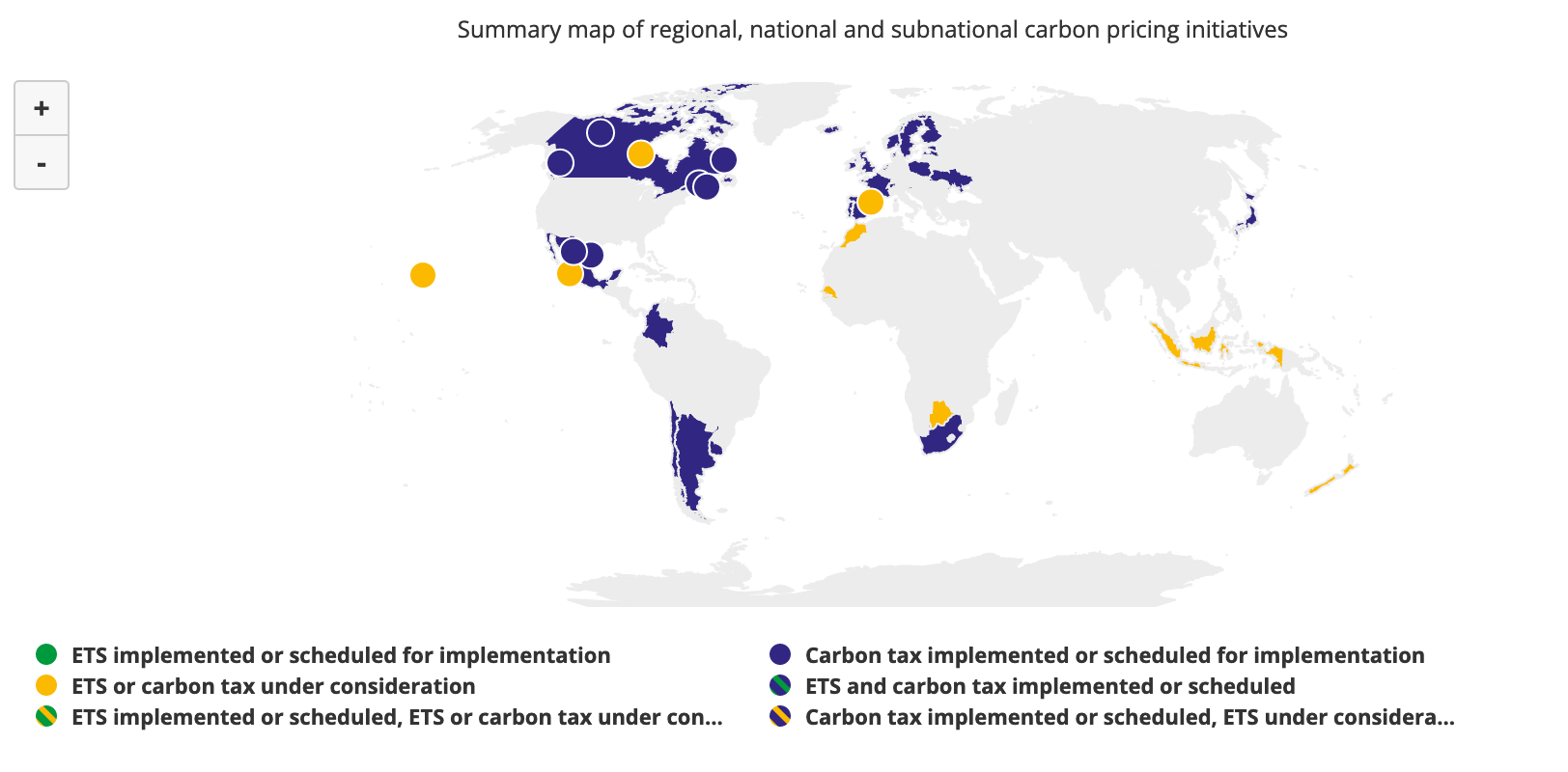

Data source: https://carbonpricingdashboard.worldbank.org/

- The EU ETS is the world's largest carbon market, covering approximately 45% of the EU's total greenhouse gas emissions.

- As of the latest data from the World Bank's Carbon Pricing Dashboard (https://carbonpricingdashboard.worldbank.org/), the carbon price in the EU ETS has shown notable variation. In 2020 the average carbon price was around €25 per tonne of CO2.

- In the years following 2020, the carbon price in the EU ETS experienced a significant increase, reaching a peak of over €50 per tonne of CO2 in 2021.

- The EU ETS has been instrumental in driving emissions reductions in the power sector and other highly polluting industries, creating economic incentives for businesses to adopt cleaner technologies and reduce their carbon footprint.

The Impact of Carbon Prices on the EU Economy

The effectiveness of carbon taxes and pricing mechanisms largely depends on the level at which they are set. The World Bank's Carbon Pricing Dashboard data indicates that if the carbon price remains above $80 per tonne, introducing additional carbon taxes will unlikely hinder economic growth in the EU. However, the success of such measures also depends on the readiness of local economies to adapt to this change.

The Green Deal and the End of "Free Pollution"

The EU's Green Deal aims to end "free pollution." In addition to reducing greenhouse gas emissions, a new carbon tax for road transport and building heating is anticipated to be implemented in 2027. These carbon fees will be calculated based on greenhouse gas emissions, primarily carbon dioxide (CO2).

Differential models will estimate emissions across various economic sectors, including industry, transport, agriculture, and energy. The calculated values will then determine the tax polluters must pay based on their emissions levels.

Carbon taxes in the EU are calculated in the respective country's currency, and the tax amount may vary due to different national legislative conditions.

A new carbon market is set to launch in 2027 for car fuel suppliers and greenhouse-emitting heat plants, eventually extending to sea transport and air travel in 2028, as well as waste incinerators.

Differential models will estimate emissions across various economic sectors, including industry, transport, agriculture, and energy. The calculated values will then determine the tax polluters must pay based on their emissions levels.

Carbon taxes in the EU are calculated in the respective country's currency, and the tax amount may vary due to different national legislative conditions.

A new carbon market is set to launch in 2027 for car fuel suppliers and greenhouse-emitting heat plants, eventually extending to sea transport and air travel in 2028, as well as waste incinerators.

The Impact on Industry and Consumers

Carbon taxes can have far-reaching effects on industries. They may increase production costs, resulting in higher product and service prices. These changes will also ripple through the supply chain, impacting raw materials and production suppliers. Ultimately, consumers may feel the effects of increased costs.

Encouraging Green Investments

The EU actively encourages industries to invest in, develop, and implement new green technologies in response to these challenges. This push is complemented by the need to expand investments in energy efficiency and replace inefficient equipment and technologies. These efforts aim to reduce emissions and mitigate the need for carbon taxes.

Ultimately, the goal is to transition away from solid fuels, increase the production and use of renewable energy sources (RES), invest in energy storage solutions, including green hydrogen, and adopt effective resource management practices. These changes can drive economic growth while reducing carbon emissions.

Ultimately, the goal is to transition away from solid fuels, increase the production and use of renewable energy sources (RES), invest in energy storage solutions, including green hydrogen, and adopt effective resource management practices. These changes can drive economic growth while reducing carbon emissions.

The Impact on Bulgarian Businesses

Bulgaria, for example, anticipates generating BGN 2.4 billion in revenue from the sale of greenhouse gas emission allowances from installations in 2023. This estimation is based on a conservative analysis by Sandbag and futures prices on the ICE exchange until December 2025. It includes revenue from auctioned allowances, with an average carbon dioxide price per tonne at €90.

When carbon taxes are applied across the entire Bulgarian economy, the country will receive a significant revenue source that must be allocated wisely. Experts estimate that this revenue could exceed 5-6 billion BGN. Although there are no concrete plans for introducing carbon taxes in Bulgaria or a set timeline for their implementation, they will likely be calculated based on the amount of greenhouse gas emissions associated with each business.

When carbon taxes are applied across the entire Bulgarian economy, the country will receive a significant revenue source that must be allocated wisely. Experts estimate that this revenue could exceed 5-6 billion BGN. Although there are no concrete plans for introducing carbon taxes in Bulgaria or a set timeline for their implementation, they will likely be calculated based on the amount of greenhouse gas emissions associated with each business.

The Role of Hydrogen in the Green Economy

In pursuing a sustainable and low-carbon future, hydrogen has emerged as a vital player in the green economy. Hydrogen, mainly green hydrogen, holds immense promise as a clean energy carrier that can help decarbonise various sectors and complement carbon pricing efforts.

Understanding Green Hydrogen

Green hydrogen is produced through electrolysis, wherein renewable energy sources, such as wind or solar power, are used to split water molecules into hydrogen and oxygen. Unlike traditional hydrogen production methods that rely on fossil fuels and emit greenhouse gases, green hydrogen production is entirely emissions-free. This attribute aligns perfectly with the EU's ambitions to reduce carbon emissions and promote cleaner energy sources.

The EU's Hydrogen Strategy

The European Union has embraced the potential of green hydrogen as a critical component of its Green Deal and carbon pricing initiatives. In July 2020, the EU unveiled its Hydrogen Strategy, outlining a comprehensive approach to developing hydrogen as a clean energy source. Key highlights of the strategy include:

Understanding Green Hydrogen

Green hydrogen is produced through electrolysis, wherein renewable energy sources, such as wind or solar power, are used to split water molecules into hydrogen and oxygen. Unlike traditional hydrogen production methods that rely on fossil fuels and emit greenhouse gases, green hydrogen production is entirely emissions-free. This attribute aligns perfectly with the EU's ambitions to reduce carbon emissions and promote cleaner energy sources.

The EU's Hydrogen Strategy

The European Union has embraced the potential of green hydrogen as a critical component of its Green Deal and carbon pricing initiatives. In July 2020, the EU unveiled its Hydrogen Strategy, outlining a comprehensive approach to developing hydrogen as a clean energy source. Key highlights of the strategy include:

- Scaling Up Production: The EU aims to scale up hydrogen production capacity to 10 million tons by 2030, primarily focusing on green hydrogen.

- Investing in Research and Innovation: The EU plans to invest in research and innovation to reduce the cost of hydrogen production, making it more competitive with fossil fuels.

- Creating Hydrogen Ecosystems: The strategy envisions the creation of hydrogen ecosystems, including the development of hydrogen valleys and innovation clusters that promote the use of green hydrogen across various sectors.

- Hydrogen in the Energy Transition: Hydrogen is seen as a crucial element in the EU's transition to a clean energy system, complementing the growth of renewable energy sources and enabling sector coupling, where energy from one sector can be used in another.

The Synergy Between Carbon Pricing and Green Hydrogen

Carbon pricing mechanisms and green hydrogen are not mutually exclusive; they complement each other in the journey toward decarbonisation. Carbon pricing provides a financial incentive for industries to reduce their emissions, encouraging the adoption of green technologies and practices. Meanwhile, green hydrogen offers a clean energy alternative to help these industries achieve their emission reduction targets.

Moreover, revenue generated from carbon pricing measures, such as carbon taxes, can be reinvested into developing green hydrogen infrastructure and technologies. This synergy creates a virtuous cycle where carbon pricing drives emissions reductions, and green hydrogen accelerates the transition to a low-carbon economy.

Moreover, revenue generated from carbon pricing measures, such as carbon taxes, can be reinvested into developing green hydrogen infrastructure and technologies. This synergy creates a virtuous cycle where carbon pricing drives emissions reductions, and green hydrogen accelerates the transition to a low-carbon economy.

What does that mean for your business?

As the EU continues to lead the charge in the fight against climate change, the role of green hydrogen in the green economy cannot be overstated. It offers a clean and versatile solution to decarbonise various sectors, from industry to transportation and energy storage.

When combined with effective carbon pricing mechanisms like the EU Emissions Trading System, green hydrogen becomes a powerful catalyst for achieving ambitious emission reduction goals.

Businesses that embrace green hydrogen technologies and adapt to evolving carbon pricing regulations stand to benefit from reduced emissions, enhanced sustainability, and a competitive edge in a rapidly changing market.

The symbiotic relationship between carbon pricing and green hydrogen holds the key to a greener and more sustainable future for businesses and our planet.

When combined with effective carbon pricing mechanisms like the EU Emissions Trading System, green hydrogen becomes a powerful catalyst for achieving ambitious emission reduction goals.

Businesses that embrace green hydrogen technologies and adapt to evolving carbon pricing regulations stand to benefit from reduced emissions, enhanced sustainability, and a competitive edge in a rapidly changing market.

The symbiotic relationship between carbon pricing and green hydrogen holds the key to a greener and more sustainable future for businesses and our planet.

How Hydrogenera Can Help Your Business Thrive in the Green Economy

As we transition to a sustainable and low-carbon future, the role of hydrogen, mainly green hydrogen, has become increasingly crucial. To capitalise on the opportunities presented by green hydrogen and carbon pricing initiatives in the European Union, businesses need a strategic partner that understands the complexities of this evolving landscape.

Hydrogenera is your trusted partner in the green hydrogen revolution. We are committed to helping businesses across various sectors harness the potential of green hydrogen while navigating the dynamic world of carbon pricing.

Hydrogenera is your trusted partner in the green hydrogen revolution. We are committed to helping businesses across various sectors harness the potential of green hydrogen while navigating the dynamic world of carbon pricing.

Contact Hydrogenera Today

The green economy, driven by initiatives like the European Union's Green Deal and carbon pricing mechanisms, offers immense potential for businesses willing to embrace sustainability and innovation. Hydrogenera is your partner in this transformative journey.

Together, we can shape your business's greener, more sustainable future and contribute to a healthier planet.

Don't miss the opportunity to lead in the green economy – choose Hydrogenera as your trusted partner on the path to sustainability and success.

If you're ready to explore the benefits of green hydrogen and navigate the complexities of carbon pricing, contact Hydrogenera today.

Together, we can shape your business's greener, more sustainable future and contribute to a healthier planet.

Don't miss the opportunity to lead in the green economy – choose Hydrogenera as your trusted partner on the path to sustainability and success.

If you're ready to explore the benefits of green hydrogen and navigate the complexities of carbon pricing, contact Hydrogenera today.